Exploring your options in rental properties can be both exciting and daunting. With numerous choices and factors to consider, it's crucial to have a clear understanding of your property needs and desires. In this guide, we dive into everything you need to consider and...

Ultimate Guide to Selling Your Property in Canberra

Ultimate Guide to Selling Your Property in Canberra

Overview of the Property Selling Process in Canberra.

Deciding to sell your home can be a challenging experience, from determining the value of your property to negotiating with buyers and closing the sale, there are many factors to consider.

But, with some preparation, the right mindset, and the right agent, you can navigate the property market successfully and sell your home for the best price.

In this article, we’ll provide some helpful tips to help you sell your property in Canberra (and surrounds) smoothly and efficiently.We’ll cover all the essential steps you need to take in order to maximise your profits and successfully sell your property

Deciding to Sell

When considering selling, it’s best practice to set a real estate goal and familiarise yourself with recent property sales in your area.

Comparing your property to similar properties in the area will give you an idea of the market value of your property and help you set a competitive (and realistic) asking price.

To maximise the value of your home, before you list your property for sale, we highly encourage you to ensure it’s in peak condition.

We recommend conducting an in-depth inspection of your home and creating a list of any necessary repairs or renovations to take care of, no matter how big or small, in order to increase your chances of a successful sale.

Below are some additional things you can do:

- Determine Your Motivation for Selling

- Request a Professional Appraisal

- Make Necessary Repairs and Improvements

- Stage Your Property for Inspections

- Consider Hiring a Professional Stager

- Gather Necessary Documents

Determining Your Home’s Value in Canberra

Get a Professional Valuation

A Market Appraisal, also known as a property valuation or real estate appraisal, is the estimated value of a piece of real estate, at a specific point in time.

Market appraisals are typically conducted by professional appraisers, who use their expertise and knowledge of the local market to determine the value of a property.

There are several factors that can influence the value of a property, including its location, size, age, condition, and features.

Professional appraisers will consider these factors and compare the property to similar properties, that have recently sold, in the area to determine its value.

Market appraisals are often conducted for a variety of purposes, including when a property is being bought or sold, when a mortgage is being taken out or when a property is being refinanced.

They can also be useful for estate planning purposes and when determining the value of a property for insurance purposes.

FAQ: How Does a Sales Agent Appraise the Value of My Property?

FAQ: What Does an Appraiser Look for in My Property?

What are the Key Components of a Market Appraisal?

The Estimated Fair Market Value

In a property appraisal, the value of a home is determined by a professional appraiser after carefully evaluating the home’s features and examining recent sales in the surrounding market. The estimated fair market value of a house takes into account various factors, including its size and location.

For instance, a four-bedroom house in Kingston may have a higher asking price than a similar property in Braddon or Belconnen. Additionally, a three-bedroom, two-bathroom house located in Charnwood, Higgins, Calwell or Banks may be more affordable than a similar property located in Canberra’s CBD.

The Actual Market Value

A professional appraiser provides a detailed explanation of the methodology used to determine the final value of the property. This may include market data analysis, the sales comparison strategy and the cost and income approaches, which consider comparable sales and potential rental income in the area.

When calculating fair market value for a residential property, you need to consider three things:

- The current market value of your home

- The location / type of neighbourhood and the condition of your property

- Any improvements that have been made on your home

Property Overview

Property appraisal is a serious business. It involves evaluating a property’s condition, location, square footage, recommended occupancy, floor plan, living area, number of bedrooms, number of bathrooms, design and quality of construction, heating and cooling systems, landscaping, type of ownership and so forth.

If you’re considering selling your house for more than the original purchase price (or if you’re wondering how much someone else should pay), consider hiring a professional appraiser, who can help you determine what’s going on with your home, and how much it’s worth.

A professional appraiser will include several of, if not all, the details mentioned above when creating their appraisal report for your property.

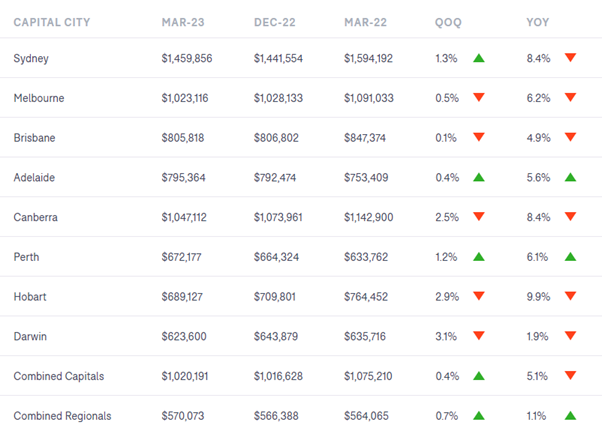

Your Local Property Market’s Trend

It’s important to stay up to date on local and national market trends in order to provide an accurate home valuation. Data from open homes, auctions, and sales of similar homes in the area is used to determine current market values and further information is gathered on comparable properties, public records and local market analysis.

Staying up to date on the current market trends and happenings will help you understand how your property fits within the broader market.

Other Considerations

Any easements or encroachments on your property could affect the market value of your property and should be included in your report, if they are relevant. If there are easements on your property that restrict potential buyers’ access to their intended use, this should be reflected in your appraisal.

The following features will affect a home’s value:

- The floor plan (including size)

- The location and neighbourhood (including local crime statistics)

- Any structural damage (such as water damage or foundation issues) and our personal favourite, THE STORY.

FAQ: How Can I Prepare My Property for Sale?

FAQ: When is the Right Time to Sell in Canberra?

FAQ: How Often Will I Hear From My Agent?

FAQ: Can You Keep My Listing Private?

Selecting the Right Sale Method for Your Property

There are many important decisions you’ll need to make, from choosing the right sales method to setting a price that works best for you.You can start by asking yourself: “How do I want to sell my property?”

When selling your property, you have the option to choose between a private treaty or an auction as your sales method.

Consider asking an experienced real estate agent to assist you with determining the most suitable sales method. Agents will base the sales method of your property on the type of property you are selling, the current market conditions and the recent sales in the area.

Understanding different sale methods (auction, private treaty, etc.) in the ACT context.

Private Treaty

Selling your property via private treaty has its pros and cons.

Pros: your property can be advertised on the market for a longer period of time, allowing you more time to consider offers.

Cons: you face the risk that your property may not sell if the asking price is too high (or you may miss out on maximising the price, if it is advertised too low).

Auction

Selling your property via auction creates competition between buyers and provides the opportunity to drive the sale price up. However, it can be a risky option as you will not know of interested buyers, or what they think your property is worth, until the day of the auction.

It’s important to make sure your price guide (and ultimately your reserve price, pre-auction) is in line with the prices of similar properties in your area, so you don’t deter potential buyers. Keep in mind that while you may have an ideal price in mind, it’s important to be realistic in order to attract interested buyers.

Property prices in different suburbs of Canberra can vary significantly from month to month, based on the rise and fall of property prices seen all over Australia.

Preparing Your Property for Sale

Determining the best month to sell can vary, and the results might be surprising to you. We recommend researching your area to see what the best time to list your home might be.

Spring Listing

Spring is often considered a great time to sell a property, as the weather is pleasant, and more people are out and about. However, it’s important to keep in mind that just because it’s a popular time to sell, it doesn’t necessarily mean that your home will be an instant hit in the market.

In the spring, there are often more properties on the market, which means that there may be more competition, thus more options for potential buyers. However, if your home is well-presented and priced appropriately, you could still experience a quick sale, with competitive offers.

Summer Listing

Summertime in Canberra typically isn’t the most ideal time to sell, due to the extreme heat and the upcoming holiday season. These factors may contribute to buyers being harder to come by and properties taking longer to sell. However, the silver-lining is the lower rate of competition during this time which may lead to higher values for your home.

Autumn Listing

Autumn is a great time to sell as people return after the summer break and start thinking about their New Year plans, which may include buying a new home. This is typically when we see a spike in prospective buyers in the market.

In addition to having more prospective buyers, the fall season has some unique advantages for selling a home. The foliage of the surrounding trees can add some extra visual appeal, and the lower angle of the sun can help brighten up properties with natural light.

Just be sure to keep an eye on falling leaves and ensure you keep your home looking its best for open homes and private inspections.

Winter Listing

While the cold season is great for a lot of family activities, these don’t necessarily include attending open homes. Due to the decrease in prospective buyer activity, the cold season isn’t the most ideal to sell your property.

However, it is still possible to achieve a successful sale during the winter, your property may just spend a little bit longer on the market, when compared to the autumn and spring seasons.

Home Improvements and Staging for Canberra’s Market

In order to maximise the value of your property, you’re going to have to put in time, money, and effort to get the best results and increase the overall profit when selling your property.

Here’s what can you do set up yourself and your property for the market:

Upkeep

To prepare a house for prospective buyers, it is important to make it as attractive as possible. This includes decluttering, cleaning, and making any necessary repairs or improvements.

Don’t forget about the garden! The exterior of your property, as well as the landscaping plays just as an important part as the interior.

Declutter

Prospective buyers often want to thoroughly inspect every aspect of a house before making a decision on whether it is suitable for them. By decluttering your home, you can showcase its essential features and avoid overwhelming prospective buyers with excess items.

Instead of trying to conceal clutter in cabinets and closets, you may want to consider renting a storage unit to keep your personal belongings out of sight during the selling process. This will help prospective buyers perceive the available storage space in a more positive light, as it will appear more spacious and organised.

Clean

After decluttering your home, it’s important to give it a thorough clean to make it shine for prospective buyers. Built-up dirt and grime can be distracting and make your house less appealing. To brighten things up, scrub down walls, baseboards, windows, and fixtures, and consider steam cleaning carpets to freshen them up and remove any potential odours.

If you’re having trouble getting your home looking its best, a fresh coat of paint can often work wonders. By taking the time to thoroughly clean and freshen up your home, you can increase its appeal and make it more attractive to potential buyers.

Go the Extra Mile

We understand not everyone has the time to dedicate to repairs and maintenance, however, the more you can do to improve the appearance of your home, the more likely you are to get a good price for it in a timely manner.

So, if you are unable to complete this work yourself, we highly recommend seeking quotes for trades. Trust us, it’s going to be well worth it.

- If something is broken – repair it! This could include cupboard doors, handles, windows, shutters, lights, etc.

- Re-do aged or dull paintwork around your property

- Replace old light bulbs or feel free to add more!

- Fix your flooring

Consider the potential changes you would make if you were moving in with fresh eyes. These changes could make a huge difference in the overall profit, as prospective buyers who see a “fixer upper” will not spend big if they intend to have money left over to pay for renovations.

Also

Read: 5 Mistakes to Avoid when Selling your Home

How Much Will it Cost To Sell My Home?

When you’re preparing to sell your home, it’s important to be aware of the various expenses that will arise during the process. Setting up a budget in advance can help you manage these costs effectively.

- Real estate agent fees: Typically around 2% of the sale price, though this rate can vary based on location and the agent you choose.

- Legal Fees (Conveyancer/Solicitor): Expect to spend between $700 and $2,500 for legal assistance during the sale.

- Marketing: These can include costs for professional photography, advertising, and signage, usually not exceeding 1% of your home’s sale price. See how we do it!

- Auction fees: about $1,000 will go to the auctioneer.

- Home staging: Updating or renting furniture for staging purposes can range from $2,000 to $4,000.

- Moving Expenses: Relocating will likely cost you between $500 and $2,000.

- Additional Fees: Be prepared for government-related charges such as mortgage discharge fees (varies by lender), Capital Gains Tax, stamp duty, and other bank-related expenses.

Open Inspections and Property Auctions

Preparing your home for viewings is a crucial step in the sales process. These viewings, commonly known as open houses, are typically scheduled well in advance to ensure your home is showcased at its best. Open houses are often organised on Saturdays or weekday evenings, providing greater convenience for potential buyers.

During these viewings, prospective purchasers may present offers to your real estate agent, either on-site or following their visit. If you opt for an auction sale, this event is generally arranged approximately one month after your property has been listed on the market. This approach offers a distinct timeline and can potentially attract competitive bidding among interested parties.

Finalising the Property Sale

Selling your property is a significant milestone, but the journey doesn’t end with accepting an offer. There are critical steps to complete before the sale is finalised and you transition to your new home. Understanding these stages is crucial for a smooth handover.

Understanding what a ‘Contract Exchange’ is

The journey towards finalising your property sale begins with the exchange of contracts. This moment occurs when you and the buyer sign the agreement formalising the sale.

The exchange of contracts marks the property’s official removal from the market. It also involves the buyer paying a deposit, typically around 10% of the property’s sale price, though this amount can sometimes be negotiated.

In auction sales, this process is more immediate, with the deposit often required on the day of the auction.

Finalising the Sale: The Settlement Period

The settlement period is the final phase in the property transaction process. It’s a critical time where the legal and financial aspects of the property transfer are finalised. During this period, typically lasting about six weeks, conveyancers or solicitors representing both parties ensure that all agreed conditions are met.

They verify property boundaries, inclusions, and legal compliance. For the seller, this period often involves preparing to vacate the property. The culmination of this phase is settlement day, where financial transactions are completed, legal ownership is transferred, and the buyer receives the keys.

As the process concludes, the real estate agent will present an invoice for their services. It’s important for sellers to review these charges to ensure they align with the initially agreed terms.