Canberra’s Property Market on a Gradual Upswing, Edging Closer to Peak Values

In an interview with Jonny Warren of Jonny Warren Properties, insights were gathered on the latest trends in Canberra’s property market, which is showing signs of recovery after a prolonged downturn. The city’s housing prices are gradually ascending towards their previous peak levels, marking an end to what has been the most severe market slump in its history.

The Domain House Price Report indicates a positive shift in Canberra’s housing market. For the first time since mid-2022, the September quarter witnessed a price increase, signaling the onset of recovery. Canberra’s median house price now stands at $1,042,730, reflecting a 1.8% rise from the previous quarter.

Dr. Nicola Powell, Domain’s chief of research and economics, confirms Canberra’s market revival. She predicts continued price growth, albeit at a moderate pace compared to the city’s historical quarterly average growth of 3.1%.

The report also notes that the combined national property market has entered its third and second quarters of growth for houses and units, respectively. Despite recent gains, Canberra’s housing market, which was the last capital city to hit a price trough in June 2023, is still 11.3% below its peak. This gap is more significant than in other capital cities.

Dr. Powell elaborates on the unique market conditions in Canberra, marked by a dramatic rise during the pandemic followed by a significant downturn. This cycle, she explains, is the most extreme Canberra has ever experienced.

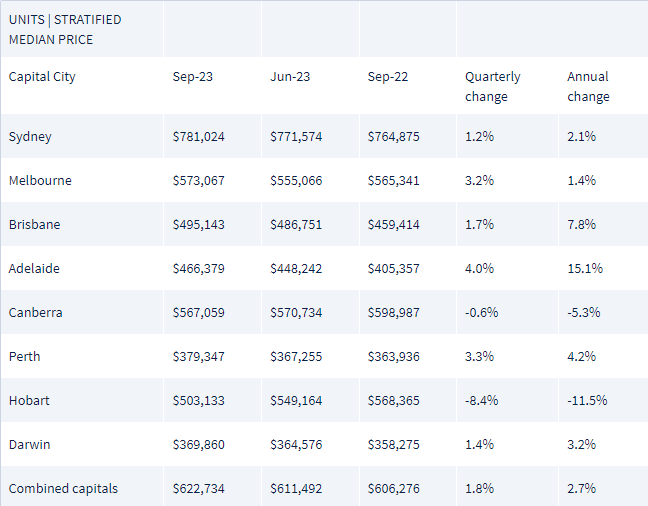

While house prices are on the upswing, unit prices have seen a slight decline of 0.6% in the September quarter, with the median unit price now 7% below its June 2022 peak. Nonetheless, Powell notes that the decline has softened compared to previous quarters.

Powell also highlights the improvement in Canberra’s listings environment compared to other cities, with total supply currently above the five-year average for this period.

Jonny Warren emphasizes that the increased stock levels have created a buyer’s market in Canberra. He notes the abundance of choices for buyers, leading to longer selling times for properties and a lack of urgency among buyers. Warren observes that sellers are even resorting to price reductions to expedite sales.

Will Honey from The Property Collective offers a different perspective, suggesting that the Canberra market is stabilizing rather than actively rising. He points out the better performance of inner suburbs compared to outer ones and notes a greater market certainty now, particularly with more stable interest rates. Honey believes that both buyers and sellers are gaining confidence, with sellers becoming more realistic about pricing compared to the peak market values. He anticipates interesting developments in the coming quarter.

Source: Allhomes